In the financial landscape of Virginia, personal loans for people with dangerous credit have develop into a important matter of discussion. With financial fluctuations and varying credit scores, many residents discover themselves in want of financial help but wrestle to safe conventional loans. This article examines the landscape of personal loans for bad credit monthly payments loans out there for these with poor credit score histories in Virginia, highlighting the challenges confronted, the choices accessible, and the implications for borrowers.

Understanding Unhealthy Credit score in Virginia

Unhealthy credit is often defined as a credit rating beneath 580. In Virginia, as in lots of different states, a big portion of the population grapples with credit score issues. Elements contributing to bad credit score embrace late funds, high credit score utilization, bankruptcies, and foreclosures. In response to recent knowledge, approximately 15% of Virginians have credit scores that fall into the dangerous credit class, making it imperative to discover viable lending options for this demographic.

The necessity for Personal Loans

Personal loans serve various functions, including debt consolidation, medical expenses, house enhancements, and emergency financial wants. For individuals with dangerous credit score, these loans is usually a lifeline. However, the problem lies in finding lenders keen to extend credit to these with a much less-than-stellar credit score historical past. Traditional banks typically have stringent necessities, leaving many potential borrowers with restricted options.

Lenders Offering Personal Loans for Bad Credit

In Virginia, several lenders cater particularly to individuals with unhealthy credit. These embody on-line lenders, credit unions, and peer-to-peer lending platforms. Every type of lender has its unique set of standards and interest rates, which may range significantly primarily based on the borrower's credit profile.

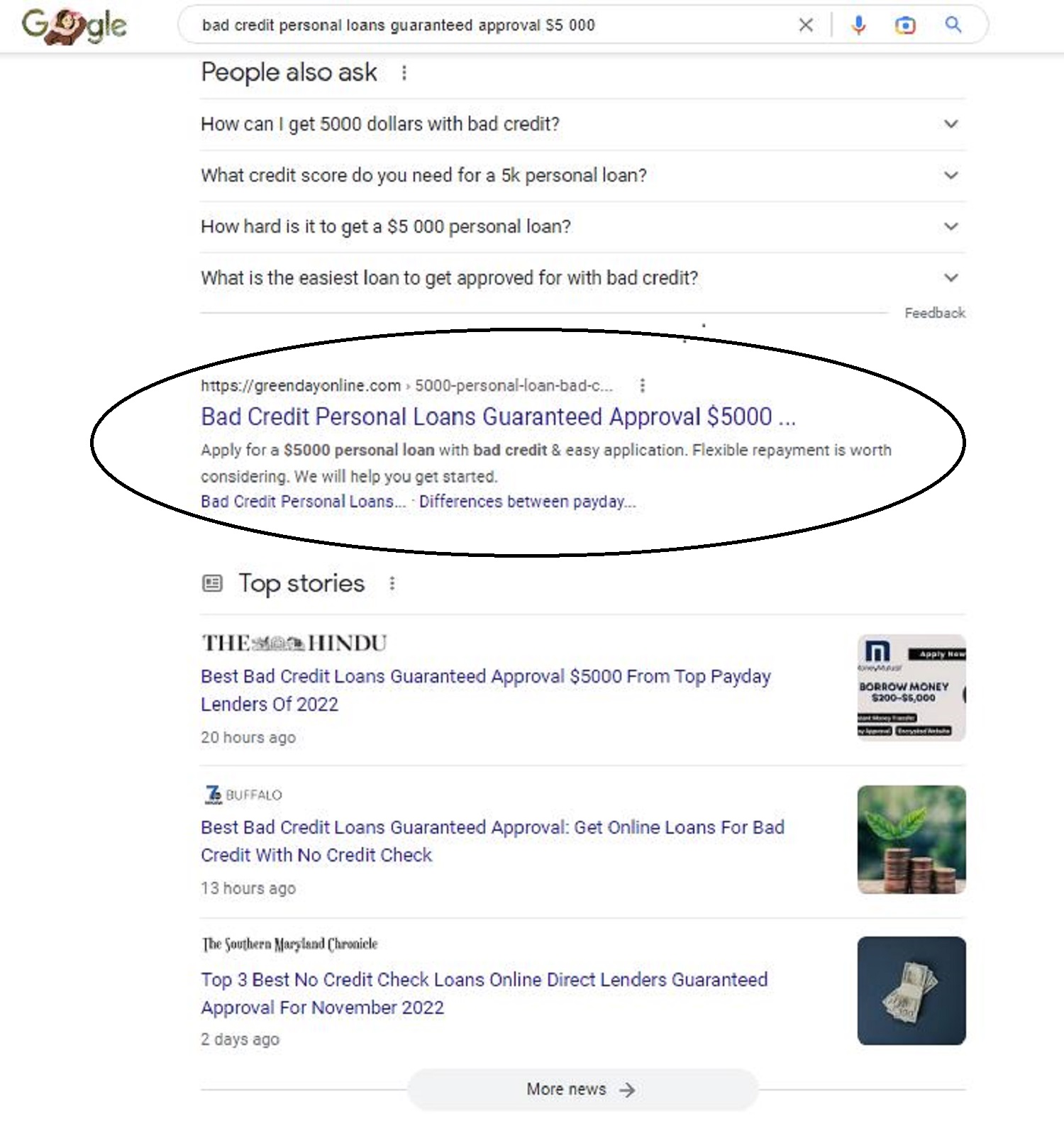

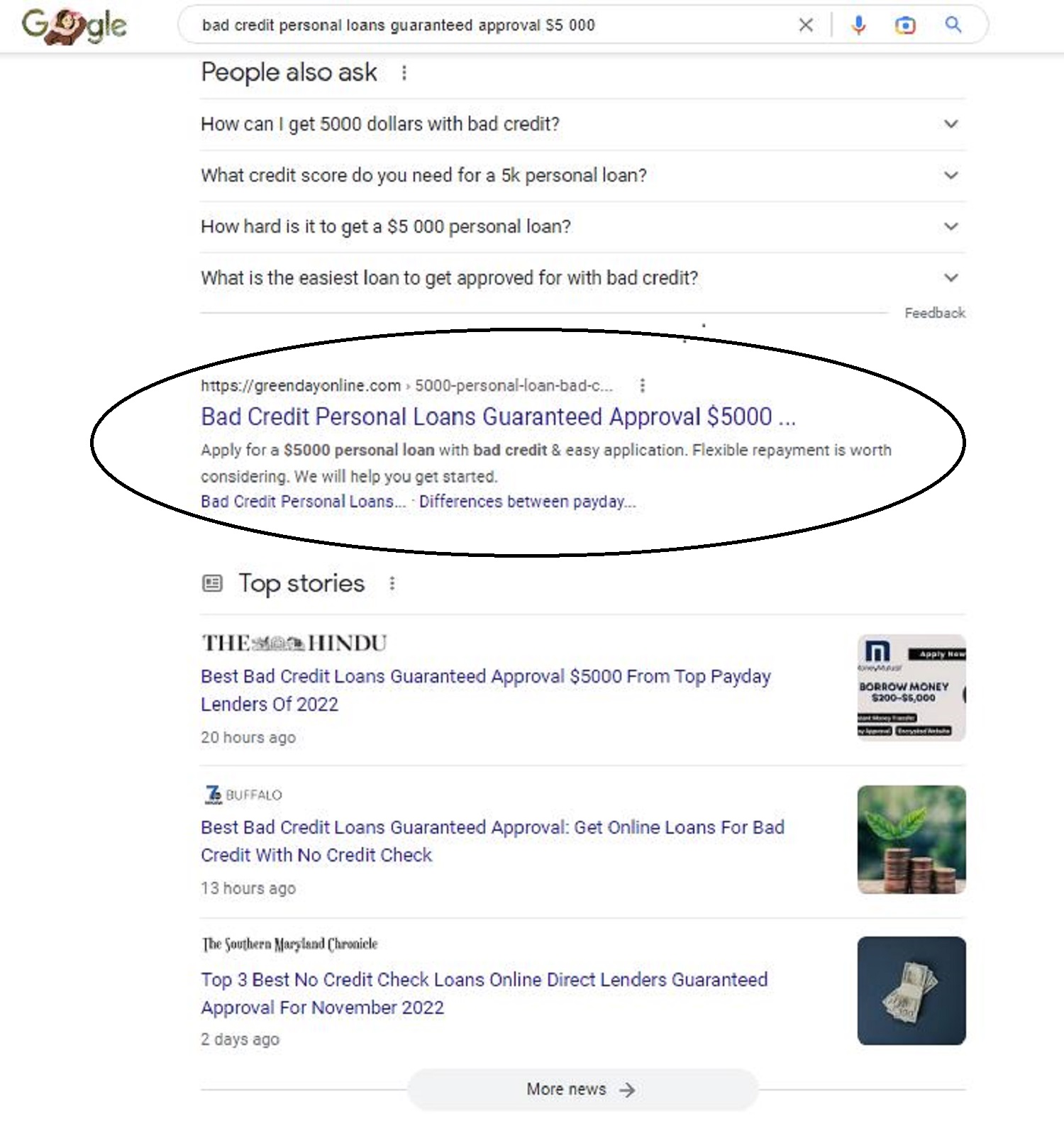

- On-line Lenders: Many online lenders have emerged as viable options for those with bad credit personal loans not payday credit. These lenders typically employ different knowledge to evaluate creditworthiness, making it simpler for individuals with poor credit score histories to qualify. Companies comparable to Avant, OneMain Monetary, and Upstart are standard selections, offering competitive rates and flexible repayment phrases.

- Credit Unions: Local credit score unions often provide personal loans with more favorable phrases than traditional banks. They may offer decrease curiosity rates and more lenient credit necessities, making them an ideal selection for borrowers with dangerous credit score. Membership in a credit score union usually requires residency or employment in the native space, which generally is a barrier for some.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper enable people to borrow cash loans for bad credit history directly from other individuals. This mannequin might be useful for those with bad credit score, as the peer-to-peer nature usually outcomes in more versatile lending criteria. Nevertheless, curiosity charges might be high, reflecting the danger taken by particular person lenders.

Curiosity Rates and Terms

The curiosity charges for personal loans concentrating on people with unhealthy credit can be significantly larger than those provided to borrowers with good credit. Rates can vary from 10% to over 30%, depending on the lender and the borrower's credit score profile. Moreover, loan terms can differ, with some lenders offering repayment durations of 36 to 60 months.

The application Course of

Making use of for a personal loan with unhealthy credit in Virginia usually involves several steps:

- Researching Lenders: Borrowers ought to evaluate numerous lenders to seek out the perfect rates and phrases. On-line critiques and testimonials can provide insight into the experiences of other borrowers.

- Prequalification: Many lenders provide prequalification, allowing potential borrowers to see estimated rates and terms with out affecting their credit scores.

- Submitting an Application: Once a lender is chosen, the borrower should full a formal application, providing best personal loan sites for bad credit information, revenue details, and any present debts.

- Receiving Approval: Approval occasions can vary. Online lenders often provide quick choices, sometimes inside minutes, whereas credit unions may take longer as a consequence of their more thorough overview processes.

- Receiving Funds: Upon approval, funds will be disbursed shortly, often inside a few days, permitting borrowers to address their financial needs promptly.

Challenges and Concerns

While personal loans can provide a lot-wanted relief for individuals with dangerous credit score, there are a number of challenges and issues to remember:

- Excessive Curiosity Charges: The price of borrowing may be significant, resulting in financial strain if not managed rigorously.

- Potential for Debt Cycle: Borrowers could discover themselves in a cycle of debt if they take out loans with out a transparent repayment plan, particularly if they are utilizing loans to cover present debts.

- Influence on Credit Rating: Taking out a personal loan can influence a borrower's credit rating. While timely funds may help enhance credit, missed payments can exacerbate existing credit points.

The Importance of Financial Training

For many people with dangerous credit, understanding the implications of taking out a personal loan is essential. Financial training performs a vital role in helping borrowers make knowledgeable selections. Sources akin to credit counseling services and monetary workshops can empower people to improve their credit score scores and manage their finances effectively.

Conclusion

In conclusion, personal loans for bad credit in virginia (https://Cproperties.com.lb) signify a crucial financial resource for a lot of residents dealing with financial challenges. While choices exist, borrowers should navigate the panorama carefully, considering the related dangers and prices. By understanding the lending environment and in search of out instructional sources, people with dangerous credit can make informed choices that result in improved monetary health. As the demand for these loans continues to develop, it is essential for each lenders and borrowers to interact in accountable lending and borrowing practices, guaranteeing that personal loans serve as a stepping stone towards monetary restoration slightly than a entice of perpetual debt.