Introduction

In recent years, the concept of investing in gold through a 401(k) Gold IRA rollover has gained significant attention among investors looking to diversify their retirement portfolios. This report aims to provide a detailed examination of 401(k) Gold IRA rollovers, including their benefits, procedures, and potential risks. In case you liked this short article in addition to you wish to receive more info relating to https://dadaprop.com/author/maximoprince4 generously check out our web-site. As the financial landscape evolves, understanding these investment options becomes crucial for individuals planning their retirement strategy.

What is a 401(k) Gold IRA Rollover?

A 401(k) Gold IRA rollover is a process that allows individuals to transfer funds from their traditional 401(k) retirement accounts into a Gold IRA, which is a specialized Individual Retirement Account that holds physical gold and other precious metals. This rollover can be an attractive option for those seeking to hedge against inflation, economic instability, and currency fluctuations, as gold has historically maintained its value over time.

Benefits of a 401(k) Gold IRA Rollover

- Diversification: One of the primary benefits of rolling over a 401(k) into a Gold IRA is diversification. By including gold in their retirement portfolio, investors can reduce overall risk and exposure to market volatility. Gold often performs well during economic downturns, making it a reliable asset for risk management.

- Inflation Hedge: Gold is often seen as a hedge against inflation. When the purchasing power of fiat currencies declines, gold typically retains its value. This characteristic makes gold an appealing option for preserving wealth over the long term.

- Tax Advantages: A 401(k) Gold IRA rollover allows individuals to maintain the tax-deferred status of their retirement savings. This means that investors do not have to pay taxes on the funds being rolled over until they begin to withdraw money from their Gold IRA during retirement.

- Asset Control: With a Gold IRA, investors have greater control over their assets. They can choose the specific types of gold and other precious metals they want to invest in, allowing for a tailored investment strategy.

- Protection from Economic Uncertainty: In times of economic instability, gold often serves as a safe retirement with gold ira haven. Investors who hold physical gold in their retirement accounts may feel more secure knowing they have a tangible asset that can withstand market fluctuations.

The Rollover Process

The process of rolling over a 401(k) into a Gold IRA involves several key steps:

- Choose a Gold IRA Custodian: The first step is to select a reputable Gold IRA custodian. This financial institution will handle the administrative tasks associated with the rollover, including the purchase and storage of gold. It is essential to research custodians thoroughly, considering factors such as fees, customer service, and storage options.

- Open a Gold IRA Account: Once a custodian is selected, the next step is to open a Gold IRA account. This process is similar to opening a traditional IRA, requiring personal information and documentation. The custodian will provide guidance throughout this process.

- Initiate the Rollover: After the Gold IRA account is established, the investor must contact their 401(k) plan administrator to initiate the rollover. This may involve completing specific forms and providing the necessary documentation to facilitate the transfer of funds.

- Select Gold Investments: Once the funds are transferred to the Gold IRA, the investor can choose which types of gold and precious metals to purchase. It is important to note that only specific types of gold are eligible for inclusion in a Gold IRA, such as American Gold Eagles, Canadian Gold Maple Leafs, and certain gold bars.

- Storage and Security: After purchasing gold, it must be stored in an approved depository. The custodian will typically arrange for secure storage, ensuring that the gold is protected and compliant with IRS regulations.

Potential Risks and Considerations

While a 401(k) Gold IRA rollover offers numerous benefits, it is essential to consider potential risks and challenges:

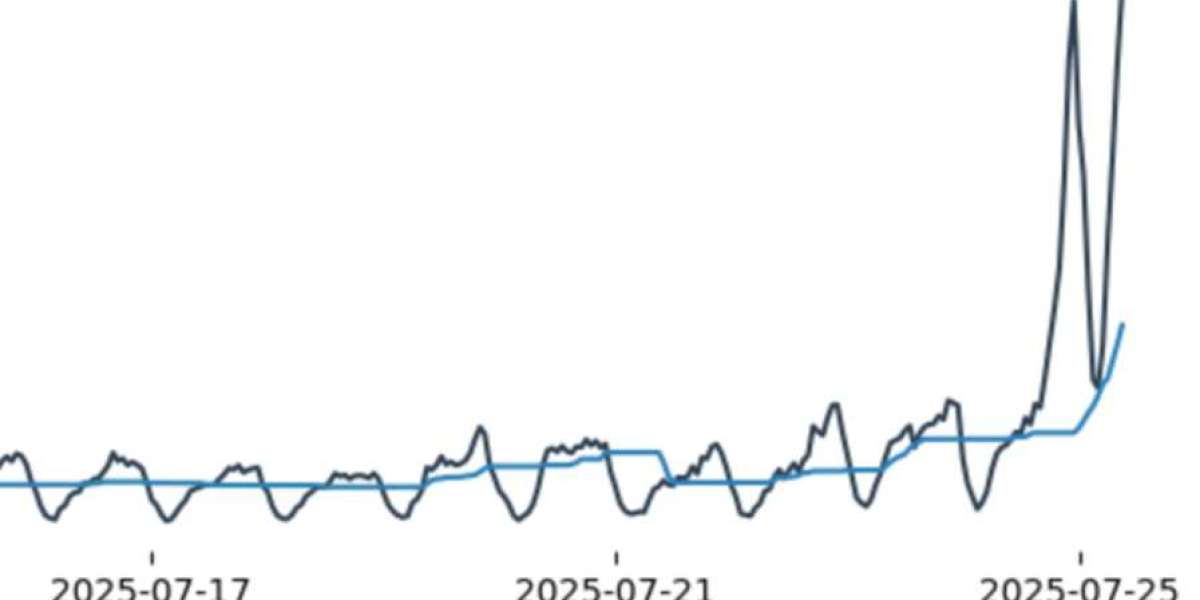

- Market Fluctuations: The price of gold can be volatile, influenced by various factors such as geopolitical events, interest rates, and market demand. Investors should be prepared for fluctuations in the value of their gold holdings.

- Fees and Costs: Gold IRAs often come with higher fees compared to traditional IRAs. These may include setup fees, storage fees, and transaction fees. It is crucial to understand the fee structure before proceeding with a rollover.

- Limited Investment Options: While gold can be a valuable addition to a retirement portfolio, it is essential to maintain a diversified investment strategy. Relying too heavily on gold may expose investors to specific risks associated with precious metals.

- Regulatory Compliance: Investors must ensure that their Gold IRA complies with IRS regulations. Failure to adhere to these rules can result in penalties and tax liabilities.

- Liquidity Issues: Although gold can be sold relatively easily, it may not be as liquid as other investments, such as stocks or bonds. Investors should consider their liquidity needs when incorporating gold into their retirement strategy.

Conclusion

A 401(k) Gold IRA rollover can be a strategic move for individuals seeking to diversify their retirement savings and protect against economic uncertainty. By understanding the benefits, procedures, and potential risks associated with this investment option, individuals can make informed decisions about their financial future. As with any investment, it is advisable to consult with a financial advisor to tailor a strategy that aligns with personal goals and risk tolerance. In an ever-changing financial landscape, a well-rounded approach to retirement planning that includes gold can provide security and peace of mind for the years ahead.