In recent years, self-directed Individual Retirement Accounts (IRAs) have gained significant popularity among investors looking to diversify their retirement portfolios. One of the most appealing aspects of self-directed IRAs is the ability to invest in physical assets such as gold and silver. As economic uncertainty looms and inflation concerns rise, many individuals are turning to precious metals as a hedge against market volatility. This article explores the benefits, regulations, and considerations of investing in gold and silver through self-directed IRAs.

Understanding Self-Directed IRAs

A self-directed IRA is a type of retirement account that allows individuals to make investment decisions on their own, rather than relying solely on a financial institution. Unlike traditional IRAs, which typically limit investments to stocks, bonds, and mutual funds, self-directed IRAs open the door to a wider range of assets, including real estate, private equity, and precious metals.

Investors can choose to establish a self-directed IRA through a custodian that specializes in alternative investments. This custodian provides the necessary administrative services while allowing account holders to direct their own investments. Importantly, self-directed IRAs must adhere to the same contribution limits and tax advantages as traditional IRAs, making them an attractive option for retirement savings.

The Appeal of Gold and Silver

Gold and silver have long been considered safe-haven assets, especially during times of economic turmoil. These precious metals tend to retain their value and can serve as a hedge against inflation, currency devaluation, and geopolitical instability. As a result, many investors view gold and silver as a way to protect their retirement savings from unpredictable market fluctuations.

In recent years, the price of gold and silver has experienced significant volatility, prompting investors to consider these metals as a viable investment option. For instance, the COVID-19 pandemic led to a surge in demand for physical gold and silver, driving prices to record highs. While prices may fluctuate, the long-term trend suggests that precious metals can provide a reliable store of value.

How to Invest in Gold and Silver Through a Self-Directed IRA

Investing in gold and silver through a self-directed IRA involves several steps. First, individuals must establish a self-directed IRA account with a qualified custodian. Once the account is set up, investors can fund their IRA through contributions or rollovers from other retirement accounts.

After funding the account, investors can begin purchasing gold and silver. However, gold ira investment guide there are specific IRS regulations that govern the types of precious metals that can be held in a self-directed IRA. The IRS mandates that only certain bullion and coins meet the criteria for inclusion in these accounts. For example, gold must be at least 99.5% pure, and silver must be at least 99.9% pure. Acceptable forms of gold include American Gold Eagles, Canadian Gold Maple Leafs, and certain bars from approved refiners.

Benefits of Investing in Precious Metals

- Diversification: Incorporating gold and silver into a retirement portfolio can provide diversification, reducing overall risk. Precious metals often behave differently than stocks and bonds, making them a valuable addition during market downturns.

- Inflation Hedge: Gold and silver have historically maintained their purchasing power during periods of inflation. As the cost of living rises, holding physical precious metals can help preserve wealth.

- Tangible Assets: Unlike stocks or bonds, gold and silver are tangible assets that can be physically held. This can provide investors with a sense of security, Gold ira investment guide especially during times of economic uncertainty.

- Tax Advantages: Investing in gold and silver through a self-directed IRA offers the same tax benefits as traditional IRAs, including tax-deferred growth and potential tax-free withdrawals in retirement.

Challenges and Considerations

While there are many advantages to investing in gold and silver through a self-directed IRA, there are also challenges and considerations to keep in mind:

- Custodial Fees: Self-directed IRAs typically come with higher custodial fees compared to traditional IRAs. Investors should be aware of these costs and factor them into their overall investment strategy.

- Liquidity: While gold and silver can be liquidated, they may not be as easily converted to cash as stocks or bonds. Investors should consider their liquidity needs when allocating funds to precious metals.

- IRS Regulations: Investors must adhere to strict IRS regulations regarding the types of metals that can be held in a self-directed IRA. Failure to comply with these regulations can result in penalties and tax liabilities.

- Storage Requirements: Physical gold and silver must be stored in an approved depository to meet IRS guidelines. This adds an additional layer of complexity and cost to the investment process.

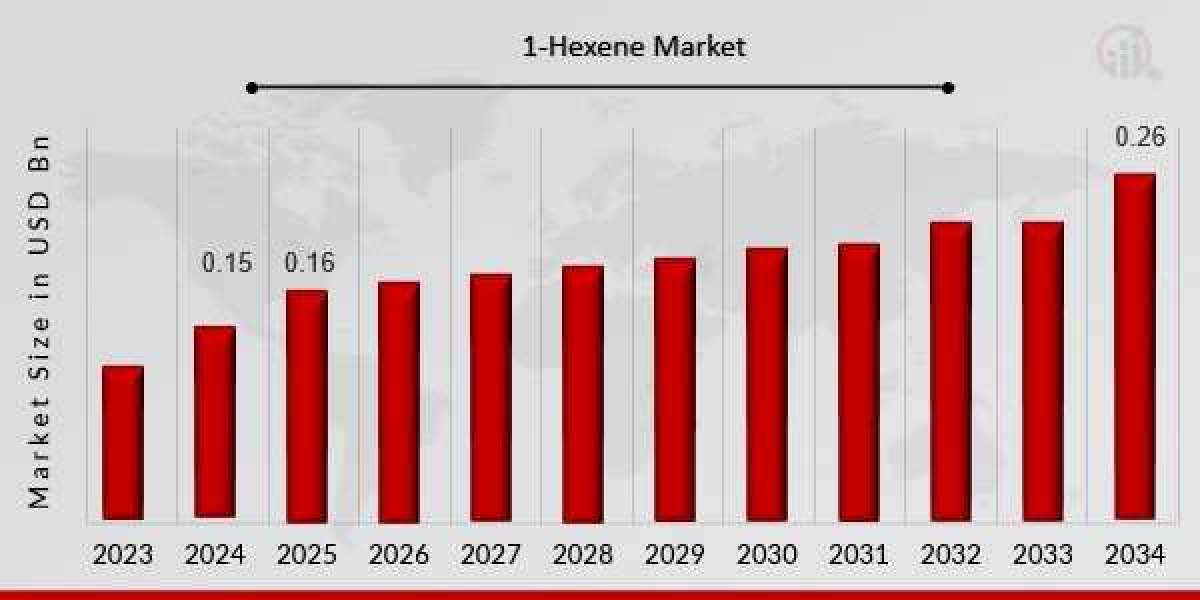

The Future of Self-Directed IRAs and Precious Metals

As the financial landscape continues to evolve, the demand for self-directed IRAs and precious metals is expected to grow. Economic instability, inflationary pressures, and gold Ira investment Guide geopolitical tensions are likely to drive more investors toward tangible assets as a means of safeguarding their retirement savings.

Financial advisors and experts recommend that individuals consider their risk tolerance, investment goals, and overall financial situation before diving into self-directed IRAs and precious metals. If you have any inquiries relating to in which and how to use gold ira investment guide, you can get hold of us at our web-site. While these investments can offer significant benefits, they also come with inherent risks.

In conclusion, self-directed IRAs for gold and silver present a compelling opportunity for investors seeking to diversify their retirement portfolios and protect their wealth. By understanding the regulations, benefits, and challenges associated with these investments, individuals can make informed decisions that align with their long-term financial goals. As more people recognize the advantages of self-directed IRAs and the stability of precious metals, the trend is likely to continue, shaping the future of retirement investing.