In recent years, the concept of investing in gold through Individual Retirement Accounts (IRAs) has gained significant traction among investors. As economic uncertainties and inflation concerns rise, many individuals are turning to gold as a safe haven asset. This case study explores the best IRA gold options available, the benefits of investing in gold for retirement, and the factors to consider when selecting a gold IRA provider.

Understanding Gold IRAs

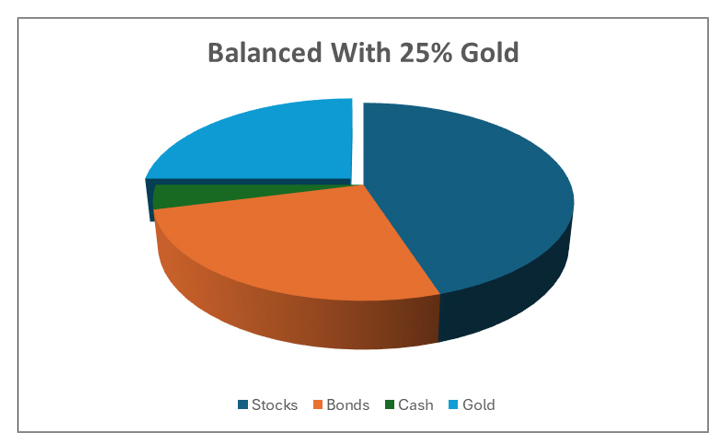

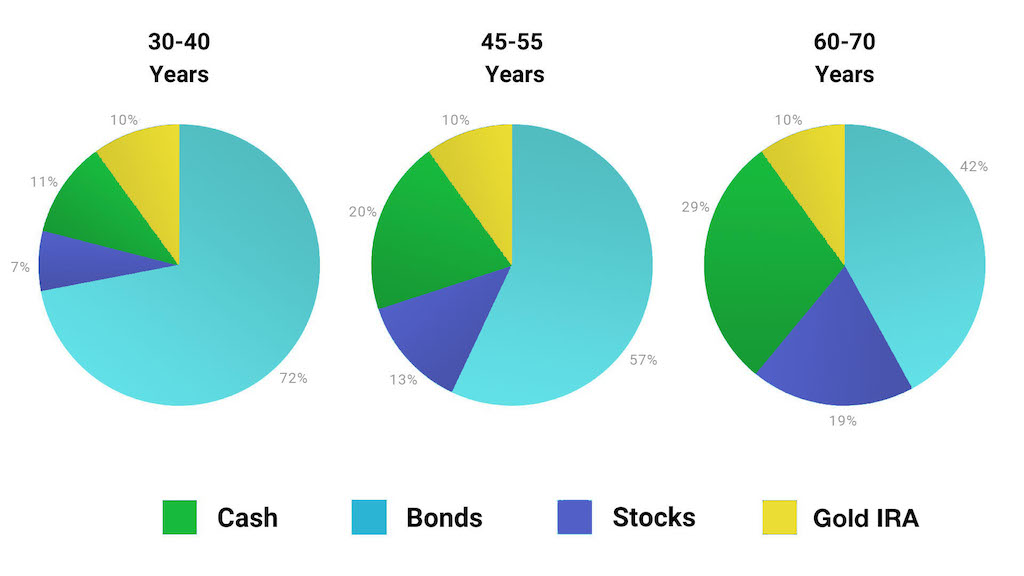

A Gold IRA is a type of self-directed Individual Retirement Account that allows investors to hold physical gold and other precious metals as part of their retirement portfolio. Unlike traditional IRAs that typically invest in stocks, bonds, or mutual funds, Gold IRAs offer a unique opportunity to diversify and protect wealth against market volatility and inflation.

Benefits of Investing in Gold for Retirement

- Inflation Hedge: Gold has historically been seen as a hedge against inflation. As the purchasing power of fiat currencies declines, the value of gold tends to rise. This characteristic makes it an attractive option for preserving wealth over the long term.

- Diversification: A well-diversified portfolio can help mitigate risks. Including gold in an trusted investment in retirement iras strategy can provide a buffer against stock market fluctuations, as gold often moves inversely to equities.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that investors can hold. This tangibility can offer peace of mind, especially during economic downturns when confidence in financial institutions may wane.

- Tax Advantages: Gold IRAs offer the same tax advantages as traditional IRAs. Contributions may be tax-deductible, and the investments grow tax-deferred until withdrawal during retirement.

Types of Gold for IRA Investment

When investing in a Gold IRA, not all gold is created equal. The IRS has specific requirements for the types of gold that can be included in an IRA. Eligible gold must meet the following criteria:

- Purity: The gold must have a minimum purity of 99.5%. This includes certain gold coins and bullion bars.

- Approved Coins: Some of the most common gold coins that qualify for IRAs include the American Gold Eagle, Canadian Gold Maple Leaf, and the Australian Gold Kangaroo.

- Bullion Bars: Gold bars from reputable refiners that meet the purity requirement can also be included.

Choosing the Best Gold IRA Provider

Selecting the right Gold IRA provider is crucial for a successful investment. Here are key factors to consider:

- Reputation and Experience: Research the provider's reputation in the industry. Look for companies with a solid track record, positive customer reviews, and years of experience in handling precious metals.

- Fees and Costs: Understand the fee structure associated with the Gold IRA. This includes setup fees, annual maintenance fees, storage fees, and any transaction costs. Compare multiple providers to find the most cost-effective option.

- Storage recommended options for gold-backed ira: Gold must be stored in an approved depository. Ensure that the provider offers secure storage solutions and that you understand the terms and conditions associated with storage.

- Customer Support: A reliable provider should offer excellent customer service. If you adored this short article and you would certainly such as to receive more info concerning gold for ira investment kindly see our own web-site. Look for companies that provide educational resources, responsive support, and personalized assistance throughout the investment process.

- Buyback Policy: A good Gold IRA provider should have a transparent buyback policy. This allows investors to sell their gold back to the company if they choose to liquidate their investment.

Top Gold IRA Providers

After thorough research and analysis, the following companies are recognized as some of the best Gold IRA providers in the industry:

- Birch Gold Group: Known for its educational resources and personalized service, Birch Gold Group has a strong reputation in the industry. They offer a wide range of gold products and have a transparent fee structure.

- Noble Gold Investments: Noble Gold is praised for its customer service and straightforward approach. They offer a variety of gold IRA affordable options for gold iras usa and have a strong buyback policy.

- Goldco: Goldco specializes in precious metals IRAs and has garnered positive reviews for its customer support. They provide a comprehensive range of services, including retirement planning and gold IRA setup.

- American Hartford Gold: American Hartford Gold is known for its competitive pricing and commitment to customer education. They offer a variety of gold products and have a strong focus on transparency in their operations.

- Regal Assets: Regal Assets has a reputation for being innovative in the gold IRA space. They offer a wide range of alternative assets, including cryptocurrencies, alongside gold, providing a unique investment opportunity.

Conclusion

Investing in gold through a Gold IRA can be a strategic move for individuals looking to secure their financial future. With the potential for inflation protection, diversification, and tax advantages, gold remains a compelling option for retirement portfolios. However, it is essential to conduct thorough research and choose a reputable Gold IRA provider to maximize the benefits of this investment. By understanding the nuances of gold investing and selecting the right provider, individuals can confidently navigate their retirement planning journey and safeguard their wealth against economic uncertainties.