gold ira companies in usa has been a logo of wealth and stability for centuries, and lately, it has gained popularity as an investment car within Individual Retirement Accounts (IRAs). The concept of incorporating gold into retirement savings is rooted in the need for a diversified portfolio that can withstand financial fluctuations and provide a hedge towards inflation. This article explores the intricacies of IRA gold, including its advantages, sorts, regulations, and concerns for traders.

Understanding IRA Gold

An IRA, or Individual Retirement Account, is a tax-advantaged account that enables individuals to avoid wasting for retirement. Traditional IRAs and Roth IRAs are the most common sorts, but there are additionally specialized accounts, such as Self-Directed IRAs, which permit for a broader vary of investment options, including valuable metals like gold. Investing in gold through an IRA will be a gorgeous possibility for those seeking to diversify their retirement portfolio past traditional stocks and bonds.

The benefits of Investing in Gold by means of IRAs

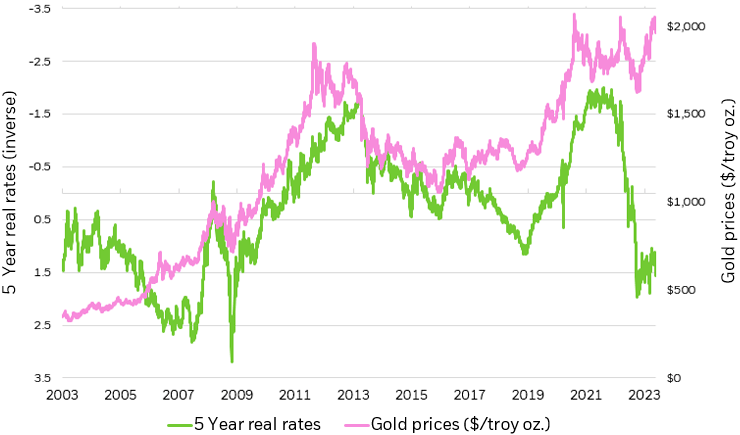

- Inflation Hedge: One in all the first reasons investors flip to gold is its historic position as a hedge in opposition to inflation. As the buying energy of fiat currencies declines, gold tends to retain its worth, offering a safeguard for retirement financial savings.

- Diversification: Gold typically moves independently of traditional asset courses, resembling stocks and bonds. By incorporating gold into an IRA, buyers can cut back total portfolio threat and enhance potential returns.

- Lengthy-Term Value: Gold has maintained its value over long durations, making it an attractive possibility for retirement savings. Not like paper property, which will be topic to volatility, gold's intrinsic worth is much less likely to be eroded by market fluctuations.

- Tax Benefits: Investing in gold ira companies for retirees by way of an IRA permits for tax-deferred growth. Which means that any positive aspects made throughout the account are not subject to taxes until the funds are withdrawn, providing an opportunity for compounding progress.

Varieties of Gold Investments in IRAs

When it comes to investing in gold inside an IRA, there are several options out there:

- Physical Gold: This contains gold bullion coins and bars that meet particular purity requirements set by the IRS. Standard options embrace American Gold Eagles, Canadian Gold Maple Leafs, and Gold Buffalo coins. It's essential to store physical gold in a secure, IRS-accredited depository to comply with regulations.

- Gold ETFs: Alternate-Traded Funds (ETFs) that track the worth of gold will also be held in IRAs. These funds present exposure to gold costs with out the necessity to physically store the metallic. Nevertheless, investors ought to remember of management charges and other costs associated with ETFs.

- Mining Stocks: Investing in gold mining firms is one other approach to achieve publicity to the gold market. While these stocks can provide leveraged publicity to gold prices, additionally they include extra risks associated with the mining trade.

- Gold Mutual Funds: Similar to ETFs, gold mutual funds put money into a diversified portfolio of gold-related property, including mining stocks and bodily gold. These funds can present a extra palms-off approach for buyers seeking gold publicity.

Regulations Governing IRA Gold Investments

Investing in gold through an IRA is topic to particular laws established by the IRS. To qualify for tax-advantaged therapy, the gold must meet certain criteria:

- Purity Standards: The IRS mandates that gold bullion will need to have a minimal fineness of 0.995 (99.5% pure). Coins should additionally meet specific purity necessities to be eligible for IRA investment.

- Authorised Depositories: Bodily gold have to be stored in a secure, IRS-authorised depository. Buyers cannot take possession reviews of the best gold ira companies the gold; it must remain within the custody of the depository to maintain the tax-advantaged status of the ira investing best gold ira companies; https://svarnabhumi.com,.

- Prohibited Transactions: The IRS prohibits certain transactions involving gold in IRAs, including self-dealing or using the gold for private use. Violating these guidelines can result in penalties and the disqualification of the IRA.

Considerations for Traders

Whereas investing in gold by an IRA can supply several benefits, there are also issues that potential buyers should keep in mind:

- Volatility: Although gold is commonly considered as a stable investment, it will possibly nonetheless experience price fluctuations. Traders must be prepared for potential volatility within the gold market.

- Storage Costs: Storing bodily gold in an authorized depository incurs fees, which may influence general returns. Traders ought to issue these costs into their resolution-making course of.

- Liquidity: Whereas gold is usually a worthwhile asset, it could not all the time be as liquid as stocks or bonds. Promoting bodily gold can take time and will involve further prices.

- Market Analysis: As with any investment, thorough research is important. Buyers should keep informed about market trends, geopolitical factors, and financial indicators that can impression gold prices.

Conclusion

Incorporating gold into an IRA is usually a strategic transfer for these looking to diversify their retirement portfolios and protect in opposition to economic uncertainty. With its historic function as a store of value and its potential to hedge towards inflation, gold stays a gorgeous possibility for a lot of traders. However, it is crucial to understand the laws, prices, and issues related to IRA gold investments. By approaching this funding thoughtfully and strategically, individuals can leverage the benefits of gold to reinforce their lengthy-term financial security.