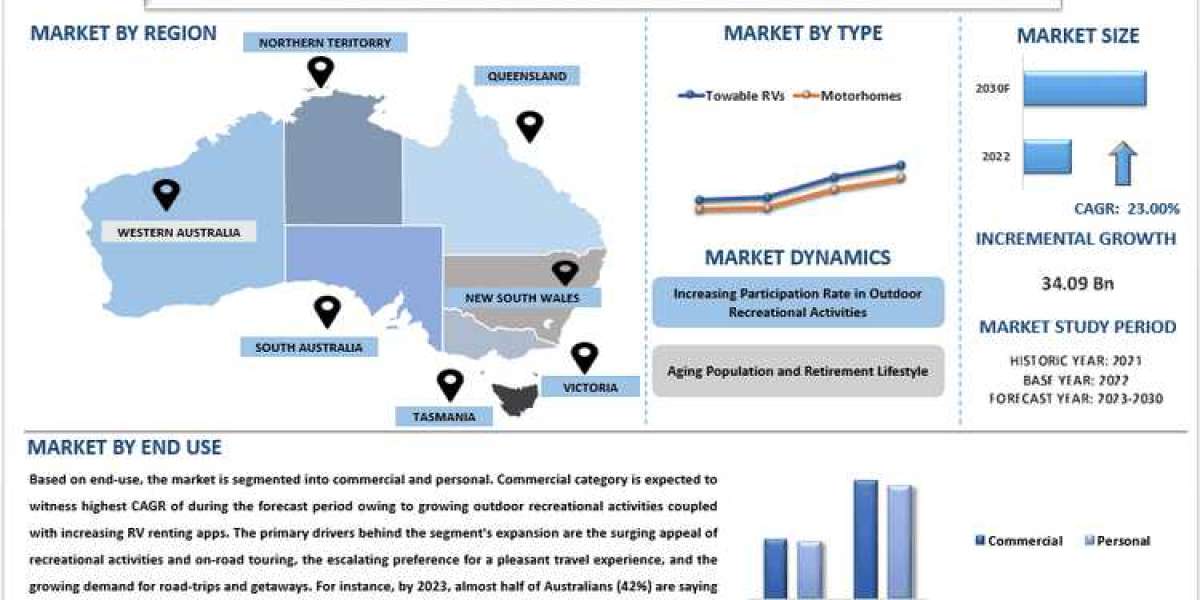

The recreational vehicle (RV) market in Queensland has witnessed robust growth over the past decade, boosted further by the surge in domestic tourism amid the pandemic. As one of Australia's premier RV manufacturing hubs and most popular holiday destinations, Queensland presents lucrative expansion opportunities for RV makers. According to UnivDatos Analysis, The Australia Recreational Vehicle Market was valued at USD 7,703.7 million in 2022 and is expected to grow at a CAGR of 23.00% during the forecast period (2023-2030).

QUEENSLAND'S RV INDUSTRY: AN OVERVIEW

Queensland is home to 20% of Australia's RV manufacturing industry, housing major manufacturers like Avida, Bullet and Sunland Caravans along with over 70 RV dealerships statewide. As per the Caravan Industry Association of Queensland (CIAQ), there are currently over 240,000 registered RVs in the state.

The state's share of Australia's total RV production has risen from 14% in 2015 to 20% in 2021, indicative of the growing focus on Queensland from RV producers. Further, over 25% of Australia's RV exports originate from Queensland, underlining its significance as a production hub.

KEY DEMAND DRIVERS

Favourable Government Initiatives

The Queensland government has introduced progressive policies aimed at positioning the state as Australia's RV tourism capital:

· Registration cost for RVs is lower than other Australian states at a concessional rate.

· Size and weight restrictions have been eased, allowing larger motorhomes and caravans on roads.

· Special RV viewing areas are being developed along major highways to boost sightseeing.

These policies are attracting interstate RV owners and manufacturers to Queensland.

PROXIMITY TO LEADING ATTRACTIONS

Queensland's vast coastline and proximity to top Australian destinations like Great Barrier Reef make it a prime base for RV travel. Many RV owners from southern regions bring their RVs on road trips to North Queensland's tropical beaches and reef islands. Additionally, Queensland's coastal highways and beaches ranked as the top route for RV travellers according to Tourism Queensland surveys. Furthermore, inland national parks like Carnarvon Gorge and island camp sites off the coast offer unique experiences for RV vacations.

These geographical advantages will continue driving Queensland's popularity for caravanning holidays.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/australia-recreational-vehicle-market?popup=report-enquiry

DEMOGRAPHICS AND LIFESTYLE TRENDS

Changing lifestyle preferences and demographics Favor the growth in RV demand. Queensland has seen higher uptake of RVs amongst millennials and first-time buyers than other states owing to RV holidays aligning with their wanderlust. The state's median age is 36, younger than the national median age of 38, indicating a demographic more inclined towards active, outdoorsy holidays. Moreover, work trends like remote employment and 4-day work weeks provide Queenslanders extended weekends and flexibility for short RV trips.

STRONG TOURISM FORECASTS

Tourism is a major contributor to Queensland's economy. Forecasts predict further growth in visitors. Domestic overnight trips are expected to cross 100 million by 2025 as per the Queensland Tourism Industry Situation Analysis report. Additionally, Tourism Research Australia forecasts international visitors to double from 2021 levels to over 1.8 million in 2023-24. This will spur demand for RV rentals and hire services to cater to tourist influx.

IMPACT OF RECENT FLOODS

Queensland's recent devastating floods have somewhat dampened tourism sentiment and infrastructure along the coast. However, resilient domestic demand is expected to uplift RV sales in the short term:

· Flood-affected residents are purchasing RVs as temporary accommodation while rebuilding houses. Avida reported strong campervan sales following the floods.

· Hire RV companies like Camplify saw bookings rise 15% after floods as displaced residents used RVs for accommodation.

While flood damage may deter international visitors, domestic travel is rebounding which will absorb the excess inventory.

GROWTH PROJECTIONS FOR QUEENSLAND'S RV INDUSTRY

Based on the current demand drivers, Queensland's RV industry is poised for steady growth over the next decade:

· By 2027, total RV registrations in Queensland could surpass 300,000 units, reflecting an annual growth rate of over 5%, according to CIAQ.

· Production levels are forecast to reach 30,000 units by 2025, higher than the state's previous peak of 27,600 units in 2013.

· Export volumes could expand at 12% annually from 2023 onwards subject to a pick-up in global conditions and travel activity.

· Employment in RV manufacturing could grow from 4,200 people in 2022 to over 6,500 by the end of the decade as per industry projections.

EMERGING TRENDS AND INNOVATIONS

Queensland's RV ecosystem is innovating with changing consumer preferences:

Apps enabling remote control of RV systems like lighting, security cameras and air conditioning are gaining popularity. Sunland's iRV touchscreen controller is an example. Additionally, lightweight construction including composite panels and 3D laminated materials allow larger RVs with improved fuel efficiency. Some luxury models feature solar roof panels, surround view cameras and entertainment systems mirroring features in top-end RVs overseas. Furthermore, ridesharing platforms like Camplify ease RV rentals for holidays while providing owners income generation options.

CONCLUSION

With Brisbane's population expected to reach 5 million by 2041, Queensland's position as Australia's fastest growing state will contribute to the soaring demand for RVs for leisure and residential purposes. Backed by proactive policies, expanding manufacturing and proximity to top natural attractions, the state is gearing up to be the RV capital of Australia. RV producers should capitalize on this potential by boosting production capacity, new product development and partnerships with Queensland's tourism operators and dealers.

Key Offerings of the Report

Market Size, Trends, Forecast by Revenue | 2023−2030.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by, Type and by End Use

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com