Automotive composites are lightweight materials made from a combination of fibers and resins used in vehicle manufacturing to reduce weight, enhance fuel efficiency, and improve performance. These composites help meet stringent environmental regulations and support the automotive industry's shift toward sustainability. The global automotive composites market is experiencing significant growth, driven by increasing demand for lightweight materials in autmotive industry to enhance fuel efficiency and meet stringent environmental regulations.

Governments worldwide are implementing stricter emission standards and fuel efficiency requirements. Automotive composites help reduce vehicle weight, which improves fuel efficiency and lowers CO2 emissions, helping manufacturers meet these regulations.

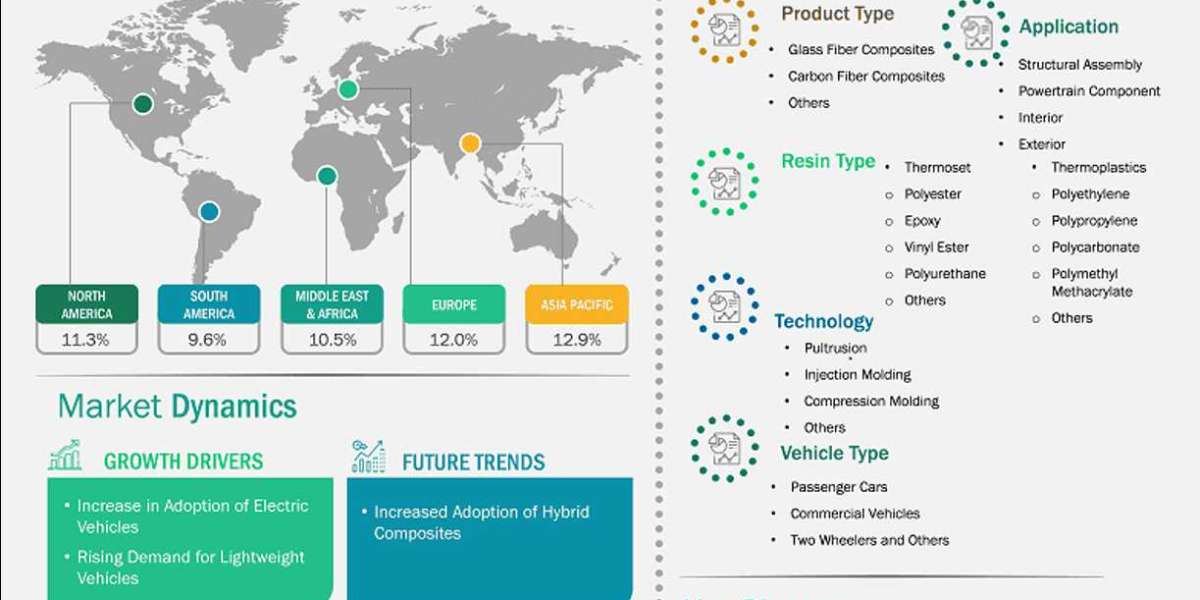

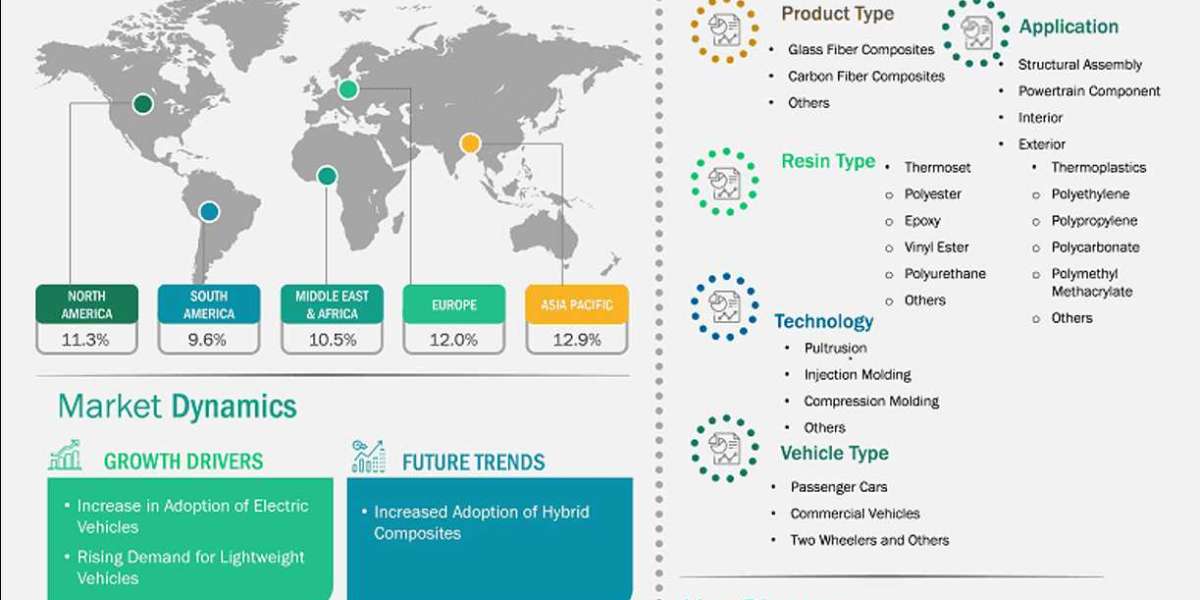

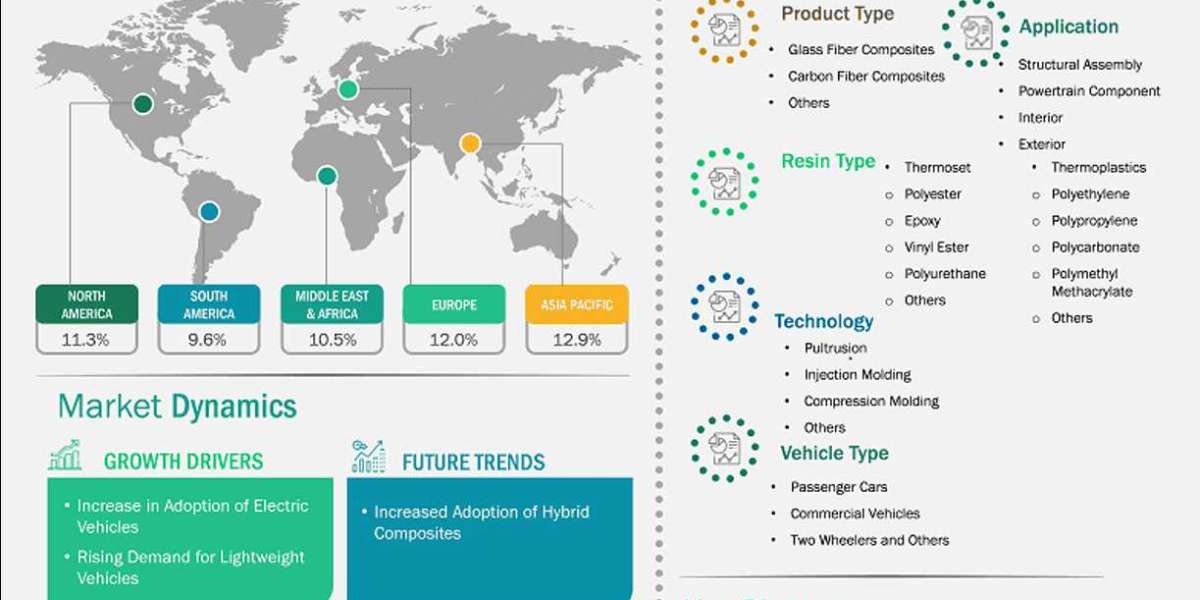

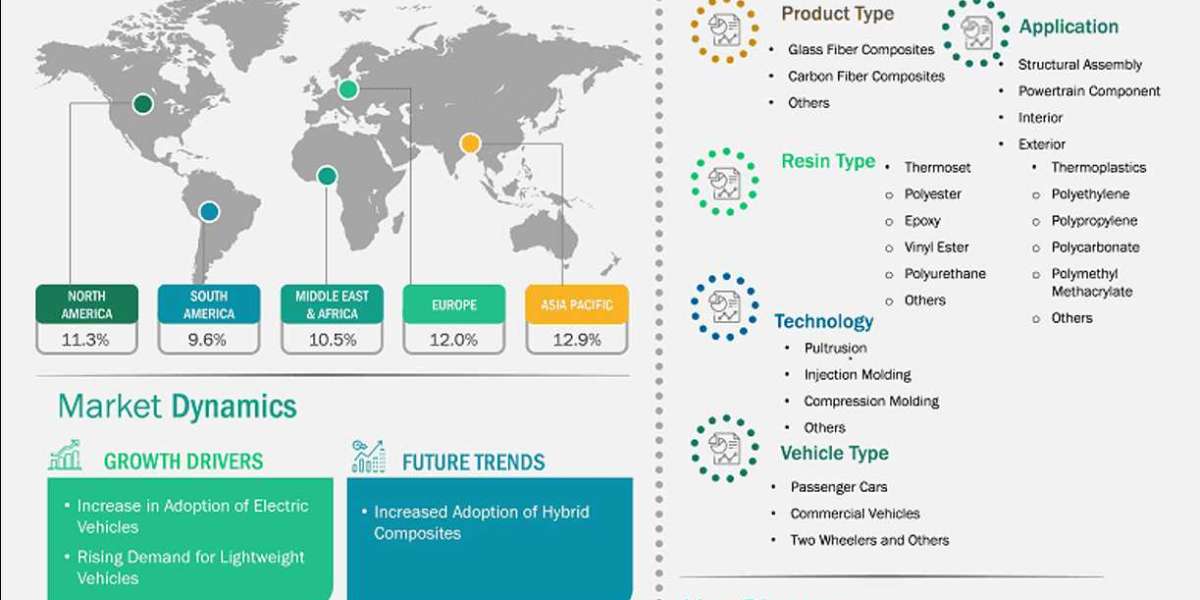

Key segments that contributed to the derivation of the automotive composites market analysis are type and application.

- By fiber type, the automotive composites market is segmented into glass fiber composites, carbon fiber composites, and others. The glass fiber composites segment held the largest share of the market in 2024.

- By resin type, the automotive composites market is segmented into thermoset (polyester, epoxy, vinyl ester, polyurethane, and others) and thermoplastics (polyethylene, polypropylene, polycarbonate, polymethyl methacrylate, and others). The thermoplastics segment held the largest share of the market in 2024.

- By resin type, the automotive composites market is segmented into thermoset (polyester, epoxy, vinyl ester, polyurethane, and others) and thermoplastics (polyethylene, polypropylene, polycarbonate, polymethyl methacrylate, and others). The thermoplastics segment held the largest share of the market in 2024

- By technology, the automotive composites market is segmented into pultrusion, injection molding, compression molding, and others. The injection molding segment held the largest share of the market in 2024.

- By technology, the automotive composites market is segmented into pultrusion, injection molding, compression molding, and others. The injection molding segment held the largest share of the market in 2024.

- By vehicle type, the automotive composites market is segmented into passenger cars, commercial vehicles, and two wheelers and others. The passenger cars segment held the largest share of the market in 2024.

- By application, the automotive composites market is segmented into structural assembly, powertrain component, and interior. The interior segment held the largest share of the market in 2024.

The global automotive industry is rapidly evolving, driven by sustainability goals, technological advancements, and consumer demand for efficiency and performance. Among the innovations reshaping the landscape, automotive composites have emerged as a cornerstone of modern vehicle manufacturing.

From boosting fuel efficiency to enabling electric vehicle (EV) innovation, composites—especially those made of carbon and glass fibers—are transforming the way vehicles are built. In this blog, we explore the key factors fueling the growth of the automotive composites market and the opportunities on the horizon.

⚡ Surge in Electric Vehicle Adoption Fuels Demand for Composites

With environmental concerns and fluctuating fuel prices gaining global attention, there’s a major shift underway in the transportation sector. Consumers are increasingly turning toward electric vehicles (EVs) and hybrid models as cleaner, more economical alternatives to traditional gasoline-powered cars.

According to the International Energy Agency (IEA), over 10 million electric cars were sold globally in 2022, and this number is expected to rise by 35% in 2023, reaching 14 million. As EV production surges, so does the demand for lightweight, durable materials—this is where automotive composites come into play.

Why Composites Matter in EVs:

Weight Reduction: Reducing vehicle weight improves battery efficiency and driving range—critical for EV success.

Design Flexibility: Composites offer greater versatility in vehicle design, helping manufacturers meet aerodynamic and safety requirements.

Durability and Safety: These materials are highly resistant to corrosion, impact, and fatigue.

To encourage EV adoption, governments around the world are introducing incentives like tax exemptions, reduced registration fees, and free charging infrastructure. For example, the US government has committed US$ 87 billion to new highway construction over the next five years, supporting the broader EV ecosystem. These favorable policies are boosting EV production and creating a robust demand for advanced composite materials.

Emerging Economies Accelerate Automotive Growth

Countries such as Brazil, China, India, Mexico, and South Africa are witnessing a boom in their automotive sectors. Rising urbanization, increasing disposable incomes, and growing infrastructure investments are all contributing to higher vehicle demand in these regions.

Let’s look at a few key highlights:

India: Passenger vehicle sales surged to 2.85 million units in November 2023, up from 2.4 million a year earlier, according to the Federation of Automobile Dealers Associations (FADA).

China: Commercial vehicle sales grew 18.3% year-on-year as of September 2023, per the China Association of Automobile Manufacturers (CAAM).

South Africa: Auto production rose 24% in 2022, reaching over 555,000 units, based on data from the International Organization of Motor Vehicle Manufacturers (OICA).

Brazil: Maintained its position as the leading producer and exporter of light and commercial vehicles in South Central America, with 2.3 million units produced in 2022.

This rapid industrial growth creates a ripple effect, boosting demand for lightweight, high-performance materials like automotive composites. These materials enable manufacturers to improve fuel economy, meet emissions targets, and produce innovative vehicle designs.

Market Size and Share: Fiber Type Analysis

The automotive composites market is segmented by fiber type, with the three primary categories being:

Glass Fiber Composites

Carbon Fiber Composites

Others

Glass Fiber Leads the Market

In 2024, glass fiber composites held the largest market share. Their dominance is attributed to several compelling advantages:

High Strength-to-Weight Ratio: Ideal for structural automotive components.

Cost-Effective: More affordable than carbon fiber alternatives.

Corrosion and Moisture Resistance: Well-suited for long-term durability.

Glass fibers are widely used in automotive interiors, engine covers, body panels, and structural components. Their adaptability and lower production costs make them especially popular in mass-market vehicles where balancing performance and pricing is key.

Future Outlook

The future of automotive composites is bright. As automakers shift toward sustainable, high-performance vehicles, the demand for innovative materials will only grow. Whether it’s enabling next-gen EVs or meeting the demands of fast-expanding auto markets in developing regions, composites are set to play a starring role.

For manufacturers, suppliers, and investors, this sector represents a dynamic opportunity to capitalize on lighter, stronger, and smarter materials that are redefining the vehicles of tomorrow.