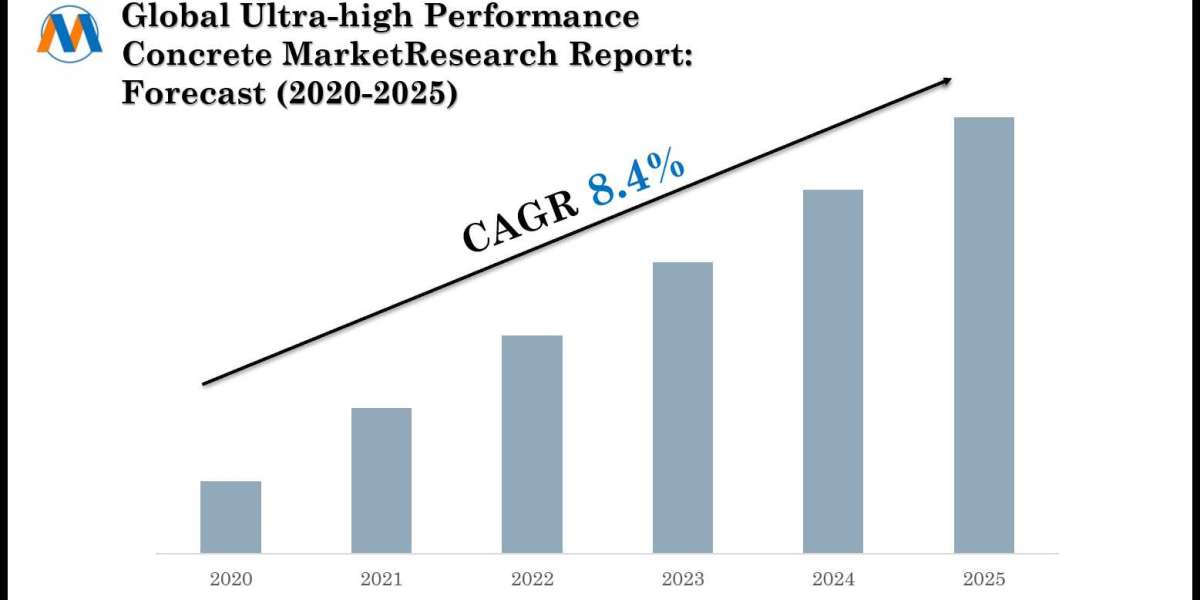

Vietnam Truck Bus Tire Market Projected to Expand at 5.86% CAGR Through 2030

The Vietnam Truck Bus Tire Market size is valued at around USD 384 million in 2024 is estimated to grow at a CAGR of around 5.86% during the forecast period, i.e., 2024-30. The country's elevated infrastructure has increased passenger and cargo movement. The nation's demand for goods and passenger transportation has expanded due to the financial boom and urbanization, that have sped up infrastructure development. These projects, which consist of building new roads, increasing present ones, and enhancing the transportation network, are all planned to grow connectivity and inspire the effective motion of people and products in the country. According to OICA, sales of commercial vehicles in Vietnam grew at a CAGR of about 2.7% during 2019-23. Nearly 241,978 commercial vehicles (LCV, MHCV) were registered in the country during 2019-23. This good-sized addition to the modern fleet of commercial vehicles is predicted to reinforce the demand for truck and bus tires during the forecast period.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Our Latest Reports Now Include In-Depth Supply Chain Ecosystem Analysis, Enabling Businesses to Navigate Tariff Challenges with Greater Agility Get Sample Report - https://www.marknteladvisors.com/query/request-sample/vietnam-truck-bus-tire-market.html

Strategic Takeaways from the Report:

- Market Sizing and Forecasting

- Regulatory and Policy Influence

- Competitive Trends and MA Activity

- Innovation Drivers and Disruptive Technologies

- Investment Hotspots and Emerging Niches

- Geographical Dynamics and Trade Flows

Vietnam Truck Bus Tire Market Segment Overview Classification

This market is categorized to offer targeted insights across various operational and consumer-related verticals.

Segment List:

By Vehicle Type

- Truck- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Bus- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

The Vietnamese truck and bus tire industry was dominated by the truck segment in 2023. As of 2023, trucks grabbed around 95% market share in the registered vehicle fleet of commercial vehicles (trucks and buses only). A similar trend was observed in the commercial vehicle tire market as well. The key reasons that can be attributed to this majority share are rapid expansion of e-commerce which has catalyzed the sales of light trucks for intercity transportation, deployment of medium and heavy trucks to transport the material for construction, and mega infrastructure sites from ports and manufacturing plants. Moreover, the expansion of ports and increase in cargo handling requirements is immensely contributing to the growth in demand for trucks. Eventually, the sales of truck tires are substantially higher when compared to the bus segment.

Two-wheelers are one of the most preferred modes of commuting in Vietnam. Of the total registered vehicle fleet of Vietnam, 60% share is cornered by two-wheelers, as reported by the Vietnam Automobile Manufacturers' Association. Moreover, the sales of buses are registering a gradual decline in the country over the past couple of years. Eventually, the market share of bus tires in Vietnam is also expected to nosedive in the forthcoming years.

By Demand Type

- OEM - Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Aftermarket - Market Size Forecast 2019-2030, Units Sold (Thousand Units)

The aftermarket segment dominated the Vietnam Truck and Bus Tire Market in 2023. Although manufacturers such as Hino, Isuzu, Ford, VinFast, Thaco, etc., have production plants in the country, their annual requirement is much lower than the aftermarket demand. The same trend is set to prevail in the forthcoming period as well. Despite several Chinese players in discussion with local companies to set up manufacturing units for commercial vehicles in the forthcoming years, the aftermarket segment will continue to hold the majority market share.

By Tire Type

- Radial - Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Bias - Market Size Forecast 2019-2030, Units Sold (Thousand Units)

By Tire Size

- Tire Size 1- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Tire Size 2- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Tire Size 3-Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Tire Size 4-Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Tire Size 5-Market Size Forecast 2019-2030, Units Sold (Thousand Units)

By Price Category

- Budget (Upto USD 180)- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Economy (USD181 to 300)- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Premium (Above 300)- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

By Sales Channel

- Direct Sales- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Exclusive Outlets- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Multi Brand Stores- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

- Online- Market Size Forecast 2019-2030, Units Sold (Thousand Units)

By Region

- Central

- East

- West

- South.

These divisions help clarify demand patterns and expected shifts.

Market Opportunities

Expanding Tourism Sector to Offer Lucrative Growth Opportunities – The developing focus of the nation on promoting tourism is also boosting the demand for buses and minivans. In the first half of 2024, almost 7.5 million tourists visited Vietnam. Whereas, around 12.6 million international tourists visited the country in 2023, and 8.3 million in 2022. So, this large increase in the nation’s tourism industry is catalyzing the enlargement of the commercial automobile market. Ultimately, the replacement demand for truck and bus tires is anticipated to surge in the coming years. Vietnam anticipates hosting around, 25 million overseas tourists by 2025 and 35 million through 2030, other than around 18 million home travelers. To accommodate this number of traveler population and their logistics requirements, the sale of commercial vehicles (trucks, buses) is expected to register exponential revenue growth. Therefore, the demand for tires from this vehicle segment is likewise expected to surge during the forecast period.

Vietnam Truck Bus Tire Market Competitive Snapshot from 2024-2030

The report highlights established and emerging players in the global Vietnam Truck Bus Tire Market, evaluating their strengths, challenges, and potential for innovation.

Key Competitors Include:

- Bridgestone Corporation

- Michelin

- Casumina (Southern Rubber Industry Joint Stock Company)

- Sailun

- Kenda

- Kumho Tire

- Zhongce Rubber Group Co., Ltd.

- Hankook

- Goodyear

- Yokohama Rubber Company

- DRC Tire

- China’s Guizhou Tyre

- Jinhu Tire

Their activities include partnerships, product launches, and geographic expansions.

Vietnam Truck Bus Tire Industry Prime Challenge

Expanding Tire Retreading Activities to Impede Market Growth – The tire retreading market in the country has been witnessing an uptick, primarily driven by the truck tires market. This expansion of the retreading industry typically increases tire mileage by a considerable amount, eventually increasing the replacement duration and reducing the total cost of ownership. This directly impacts the revenues of tire suppliers in the country. The growth of tire retreading activities in the country has an inverse relationship with the growth development of the Truck Bus Tire Industry. Thus, the expansion of the tire retreading market presents substantial hurdles to the growth expansion of the Vietnam Truck Bus Tire Market.

Frequently Asked Questions (FAQs):

- What industries are most impacted by this market?

- How is technology reshaping operations and offerings?

- Which competitors dominate the landscape?

- What risks could disrupt market expansion?

- How should businesses respond to demand fluctuations?

“Report Delivery Format: Market research reports from MarkNtel Advisors are available in PDF, Excel, and PowerPoint formats. Once payment is successfully processed, the report will be delivered to your email address within 24 hours”

Other Report:

- https://vietnammarketinsights.blogspot.com/2025/05/thi-truong-y-te-tu-xa-viet-nam-du-kien.html

- https://uberant.com/article/2108802-uae-elevator-escalator-maintenance-repair-services-market-demand-share-and-strategic-outlook-2027/

- https://globalriskcommunity.com/notes/animal-genetics-industry-value-forecast-and-competitor-insights-2

Note: If you need additional information not included in the report, we can customize it to suit your requirements. https://www.marknteladvisors.com/query/request-customization/vietnam-truck-bus-tire-market.html

Why Trust MarkNtel Advisors?

- In-depth primary and secondary data validation

- Focused on practical insights, not just raw numbers

- Designed to support business strategy, not just reporting

- Strong industry connections and real-time data flow

- Transparent methodology and reliable sourcing

About Us –

We are a leading market research company, consulting, data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial varied client base, including multinational corporations, financial institutions, governments, individuals, among others.

Our specialization in niche industries emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing forecasting, trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Address Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India